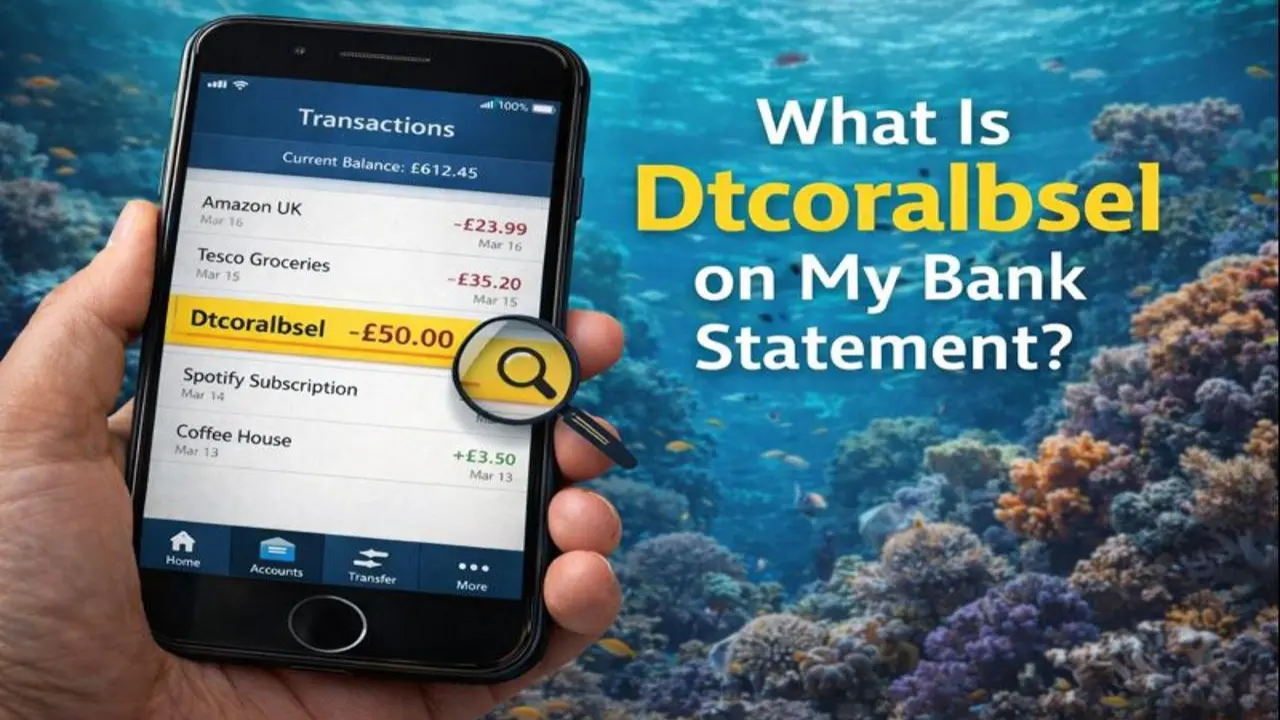

Seeing an unfamiliar entry on a bank statement can be unsettling. Many people regularly review their debit or credit card activity only to find cryptic descriptions that do not clearly match any purchase they remember making. One such term that has raised questions is Dtcoralbsel. This article is written to help readers understand what this charge usually represents, why it appears in such an abbreviated form, and how to respond calmly and effectively when it shows up on a financial statement.

The goal here is clarity. Financial terminology often feels confusing because banks shorten merchant names, use internal reference codes, or display transaction descriptors that differ from the brand name consumers recognize. By the end of this guide, you should have a strong understanding of how these codes work, what this specific descriptor generally refers to, and how to protect yourself if something does not look right.

Understanding Bank Statement Descriptors and Transaction Codes

Quick Bio

| Quick Bio Element | Details |

|---|---|

| Article Focus | Explanation of an unfamiliar bank statement transaction descriptor |

| Main Keyword | Dtcoralbsel |

| Content Type | Informational / Educational |

| Primary Topic | Understanding unknown bank statement charges |

| Industry | Banking & Digital Payments |

| User Intent | Identify, verify, and understand a transaction |

| Common Concern Addressed | Fear of unauthorized or fraudulent charges |

| Typical Source of Charge | Online betting or digital gaming transactions |

| Transaction Nature | Debit or credit card digital payment |

| Risk Level | Usually low, requires verification |

| Recommended User Action | Review account activity and contact bank if unsure |

| Target Audience | Everyday bank users and online payment users |

Before focusing on a specific descriptor, it is important to understand how bank statements are generated. When a card transaction occurs, several systems communicate with each other. The merchant submits payment information through a payment processor, which then sends a simplified version of the merchant name and transaction type to your bank.

Because of character limits and standardized formatting rules, banks often display shortened or altered names. This means the name on your statement may not look exactly like the company you dealt with. Extra letters, prefixes, or suffixes can be added to indicate transaction channels such as online, direct transfer, or card-not-present payments.

As a result, unfamiliar descriptors are not automatically a sign of fraud. In many cases, they are simply technical labels that make sense within banking systems but not to everyday customers.

What Dtcoralbsel Usually Refers To

In most reported cases, Dtcoralbsel appears to be associated with transactions linked to online betting or gaming services, commonly tied to the Coral brand operated by Coral. The descriptor is believed to combine internal identifiers with an abbreviated merchant name.

The “DT” portion often indicates a digital or direct transaction, while the rest of the descriptor corresponds to the merchant’s backend reference. This does not necessarily mean that the charge is hidden or deceptive; it usually reflects how the payment processor labels certain types of online activity.

Many people only notice this entry because it does not simply say “Coral” or “Betting.” Instead, the condensed format raises questions, especially when the transaction occurred days or weeks earlier.

Why the Charge Name Looks Unfamiliar

One of the most common reasons people search for explanations is that the descriptor does not match their memory of the purchase. There are several reasons why this happens.

First, the transaction may have been processed under a parent company name or internal merchant account rather than the brand name used on the website or app. Second, some services split deposits, withdrawals, or subscription-style activity into separate transactions, each with a slightly different label. Third, international processing can add extra characters or abbreviations.

In the case of Dtcoralbsel, the unfamiliar structure of the word itself is what prompts concern. It looks technical rather than commercial, which can trigger fears of unauthorized use even when the charge is legitimate.

Common Scenarios Where This Charge Appears

This type of descriptor most often appears in situations involving online activity. Users who have registered accounts on betting platforms, gaming websites, or digital entertainment services may encounter it. Sometimes it reflects a direct deposit made to an online wallet within a platform, rather than a single bet.

Another scenario involves promotional offers or free bet conversions. Even if no cash wager was placed, the system may still process a small verification transaction. Because these amounts are often modest, they can go unnoticed until a statement review.

Occasionally, the charge may be linked to a recurring setting within an account, such as automatic top-ups or account balance thresholds.

How to Confirm Whether the Charge Is Legitimate

If you see Dtcoralbsel on your statement, the first step is not panic but verification. Start by reviewing your recent online activity. Check emails, account notifications, or app histories related to betting or gaming services.

Next, consider whether anyone else has authorized access to your card, such as a partner or family member. Shared devices or saved payment methods can sometimes lead to forgotten transactions.

You can also look at the transaction date and amount. Small, round numbers often indicate deposits rather than purchases. Matching these details with your activity timeline can help confirm legitimacy.

What to Do If You Do Not Recognize the Transaction

If after reviewing your records you still cannot identify the charge, the next step is to contact your bank. Banks are equipped to provide more detailed merchant information than what appears on your statement. They can often tell you the registered merchant name, transaction location, and payment channel.

If the transaction is confirmed as unauthorized, your bank will guide you through the dispute process. This usually involves temporarily crediting the amount back to your account while the investigation takes place. Acting quickly improves the likelihood of a smooth resolution.

It is also wise to change passwords on related accounts and monitor future statements closely for any unusual activity.

Is This Descriptor a Sign of Fraud?

The presence of Dtcoralbsel alone does not automatically indicate fraud. In the majority of documented cases, the charge is legitimate and linked to user activity that was forgotten or misunderstood.

However, any transaction you do not recognize deserves attention. Fraud prevention relies on awareness and timely action. Even legitimate descriptors can sometimes be exploited if card details are compromised.

The key is to treat the descriptor as a prompt to review, not as proof of wrongdoing.

The Role of Merchant Codes in Online Payments

Merchant codes are essential for banks to categorize transactions and apply appropriate rules. They help determine whether a transaction qualifies for rewards, cashback, or additional security checks.

Online betting and gaming merchants often fall into specialized categories due to regulatory requirements. This can result in more complex descriptors compared to retail purchases.

Understanding this background helps explain why certain entries look technical and unfamiliar.

How Online Betting Transactions Are Processed

When you place a bet or add funds to an online account, the transaction does not always behave like a standard purchase. Funds may be routed through intermediary processors, especially for compliance and security reasons.

These intermediaries use standardized naming conventions that prioritize system compatibility over consumer readability. That is why a descriptor like Dtcoralbsel may appear instead of a brand name you immediately recognize.

This system also allows for faster processing and better tracking in case of disputes or audits.

Can the Charge Be Refunded?

Refund eligibility depends on the nature of the transaction. If it was an authorized deposit or bet, refunds are subject to the platform’s terms and conditions. Many betting services do not refund used funds but may reverse unused balances.

If the transaction was unauthorized, banks typically offer strong consumer protection. Once confirmed as fraud, the amount is usually returned, and a new card may be issued to prevent future misuse.

Understanding the difference between a legitimate but regretted transaction and true fraud is important when seeking a refund.

Preventing Future Confusion on Bank Statements

One effective way to avoid confusion is to regularly review transaction notifications through your banking app. Real-time alerts make it easier to recognize activity as it happens.

You can also keep a simple log of online accounts where your card details are stored. This makes it easier to identify potential sources when an unfamiliar descriptor appears.

Finally, using separate cards or digital wallets for specific types of spending can help isolate and track transactions more clearly.

Why Awareness Matters in Digital Banking

Digital banking offers convenience, but it also places more responsibility on users to stay informed. Understanding how transaction descriptors work empowers you to distinguish between normal activity and genuine risks.

Descriptors like Dtcoralbsel highlight the importance of financial literacy in an increasingly cashless world. The more familiar you are with how systems label activity, the less stressful statement reviews become.

This awareness also helps prevent unnecessary disputes and gives you confidence when communicating with your bank.

The Importance of Reading Statements Carefully

Many people only scan their statements for large amounts, ignoring small or technical entries. However, small transactions can provide early warning signs of issues.

Taking a few minutes each week to review activity can save significant time and stress later. It also reinforces healthy financial habits that support long-term security.

Final Thoughts on Understanding This Transaction Descriptor

Encountering unfamiliar terms on a bank statement is common, especially as digital payments grow more complex. Dtcoralbsel is one of many examples where a technical descriptor masks a transaction that is often legitimate.

By understanding how merchant codes work, verifying activity calmly, and knowing when to contact your bank, you can handle these situations with confidence. Financial clarity comes from knowledge, not assumptions, and informed users are always better protected.

Frequently Asked Questions

1. What does Dtcoralbsel mean on a bank statement?

It is a transaction descriptor commonly associated with online betting or gaming activity, usually reflecting an abbreviated merchant reference used by payment processors.

2. Is Dtcoralbsel always related to betting services?

In most reported cases it is linked to betting or gaming platforms, but confirmation should always be done by reviewing your own transaction history.

3. Should I cancel my card if I see this charge?

Not immediately. First verify whether the transaction is legitimate. If confirmed as unauthorized, your bank will advise on card replacement.

4. Can this charge appear days after the activity?

Yes, some online transactions are processed in batches, which can delay when they appear on your statement.

5. How can I avoid confusion with similar charges in the future?

Enable transaction alerts, review statements regularly, and keep track of online services where your payment details are saved.

Read More: Pedrovazpaulo Coaching A Complete Guide to Growth Leadership and Real-Life Success